Big Day For The Dollar: FOMC in Focus

FOMC Time

All eyes are on the US Dollar today as traders brace for the Fed’s September rate decision this evening. With updated economic projections and dot plot forecasts and a post-meeting press conference, there is plenty to watch today and plenty of volatility risk as a result. Going into the meeting, the baseline forecast is for the Fed to cut rates by .25% while signalling that further easing is likely necessary given the sharp downturn in the jobs market. The market is currently pricing in around .75% worth of easing ahead of year end (three .25% cuts). As such, the Fed will need to deliver a firmly dovish set of guidance and forecasts tonight to keep USD pressured lower and spark a fresh wave of selling. The risk, however, is that the Fed falls short of satisfying traders’ heavily dovish expectations, leaving USD vulnerable to a squeeze higher.

Dot Plots & Guidance

In terms of areas of focus today, the first will be how much weight Powell puts on downside jobs risks vs upside inflation risk. If Powell dwells too much on lingering inflation risks (August CPI 2.9% vs 2.7% prior), traders will likely see this as diluting easing chances over the remainder of the year. Additionally, given the three cuts priced in by the market, there is a chance the dot plot forecasts fall on a more conservative estimate such as .5% of easing this year. If the Fed does undershoot on dot plot forecasts, and Powell sounds the alarm on inflation, this could see USD squeezing higher as traders scale back easing expectations over the remainder of the year.

Technical Views

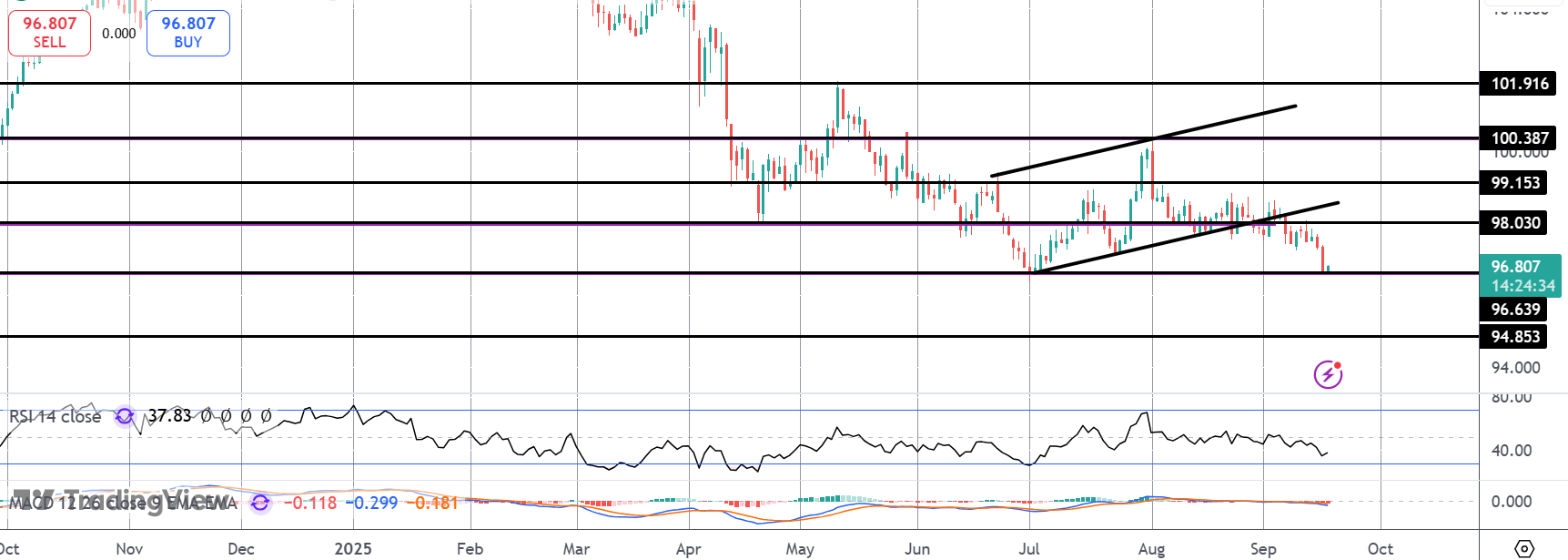

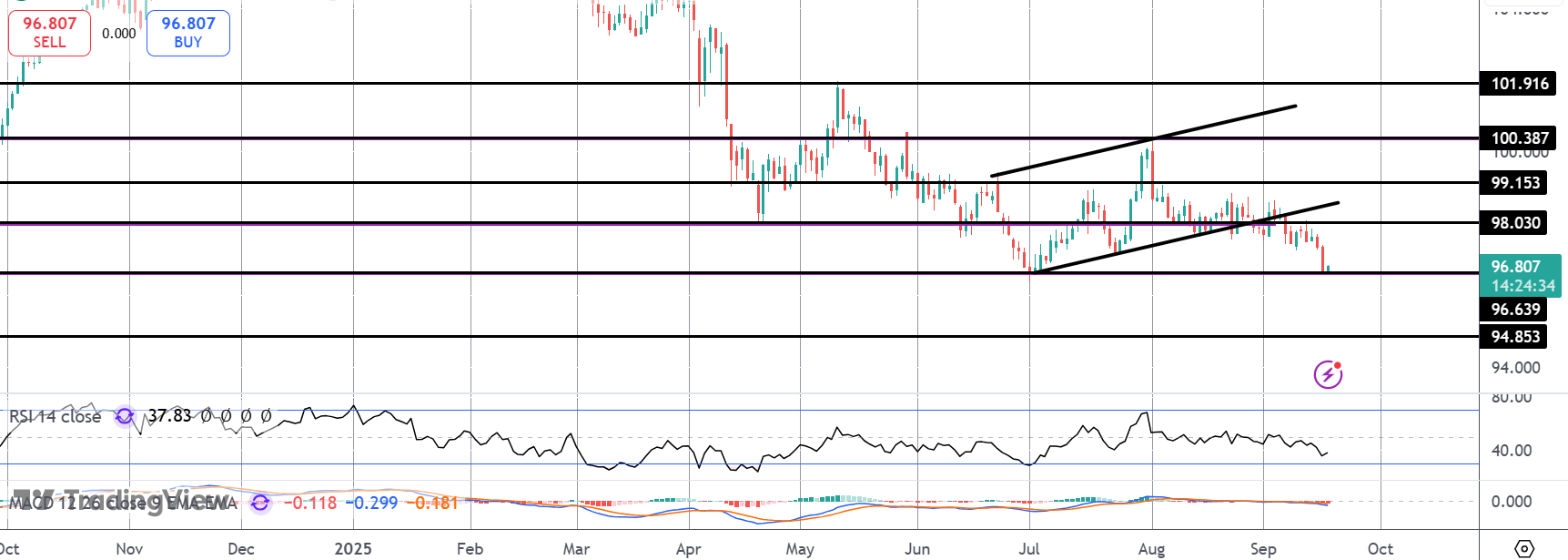

DXY

The sell off in DXY has seen the index breaking down below the bull channel with price now testing YTD lows at 96.63. With momentum studies bearish, the market is vulnerable to a break lower here with 94.85 the next support to watch if we do push lower today. Topside, 98 is the key local resistance which bulls need to break to weaken downside risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.