FTSE 100 FINISH LINE 11/12/25

FTSE 100 FINISH LINE 11/12/25

London's FTSE 100 remained steady on Thursday, supported by remarks from U.S. Federal Reserve Chairman Jerome Powell, which hinted at a less aggressive monetary policy stance than anticipated. The UK’s blue-chip index edged up 0.2% as trading neared close, reflecting cautious global sentiment that tempered gains. On Wednesday, the Fed lowered rates by the expected 25 basis points in a divided vote but signalled that further cuts are unlikely in the near term, pending more clarity on labour market conditions. While Powell emphasised a "wait-and-see" approach, his comments and the accompanying statement were less hawkish than feared, leaving room for potential easing—albeit at a slower pace. Healthcare stocks were the standout performers on the FTSE 100, with AstraZeneca rising 1% and Convatec jumping 2.6%. Miners also posted modest gains, up 0.2%, supported by higher copper prices. However, utilities slipped 0.5%, and tech stocks—though not heavily represented on the index—fell 0.8%.

Globally, tech shares faced renewed pressure as investors grew cautious following a downbeat outlook from U.S. cloud giant Oracle. Concerns over valuations and returns on substantial AI investments resurfaced, echoing the sell-off witnessed in November. Among individual movers, Entain plunged 3.4%, marking the biggest drop on the FTSE 100, after announcing that Michael Snape, an executive from International Distribution Services, will assume the roles of finance chief and deputy CEO next year, succeeding Rob Wood. Associated British Foods declined by 2% as the Primark owner traded ex-dividend, losing eligibility for its latest payout. Meanwhile, on the FTSE 250, RS Group surged 5.7% following a rating upgrade from J.P. Morgan, whereas Ceres Power fell 3.5% after Grizzly Research disclosed a short position in the clean-energy company.

TECHNICAL & TRADE VIEW - FTSE100

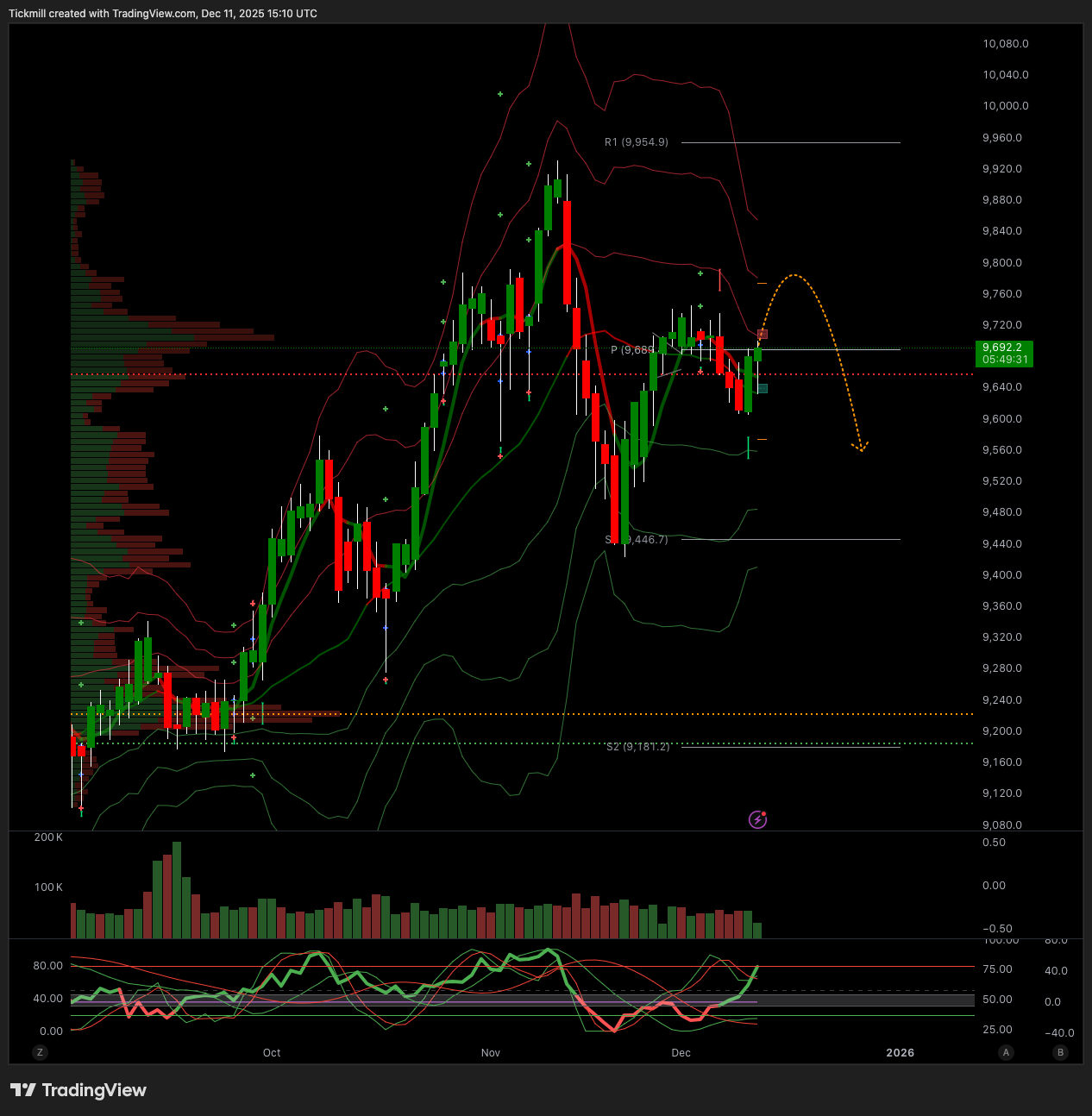

Daily VWAP Bullish

Weekly VWAP Bearish

Above 9720 Target 9783

Below 9654 Target 9550

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!