PMI Data Shows Chinese Government Still Struggling to Deliver Targeted Measures, Despite Record Support!

Despite a record amount of cheap debt poured into the economy and the expansion of fiscal spending, surveys of company managers showed that stagnation with a slight bias to recession resumed in China in July.

- The broad index of manufacturing activity, which includes enterprises of all sizes, made a tiny step in the growth direction, rising from 49.4 to 49.7 points. Nevertheless, it remains in the contraction zone for the seventh month in a row. Such behavior can be hardly called a reasonable response of manufacturing activity to tax cuts, increase in infrastructure spending and reduced cost of capital for firms.

- Return of the services PMI to declining orbit (53.7 points vs. 54.0 exp.) was especially concerning since firms from the sector appear to be free from the burden of transformation of Chinese economy from supply-side to demand-side. Therefore they should positively react to the government stimulus. The index fell to the lowest level in 1.5 years.

Here are positive points of the report:

- The output component rose 0.8 points to 52.1, while the new order component rose 0.2 to 49.8 points, remaining in contractionary territory.

- Among the 21 sectors surveyed, 12 were in the expansion zone compared to 9 in June.

- An uptick in corporate expectations component to 53.6 points underpinned market expectations for rosy numbers in the next month PMI.

As for the negative aspects of the report, their number was higher:

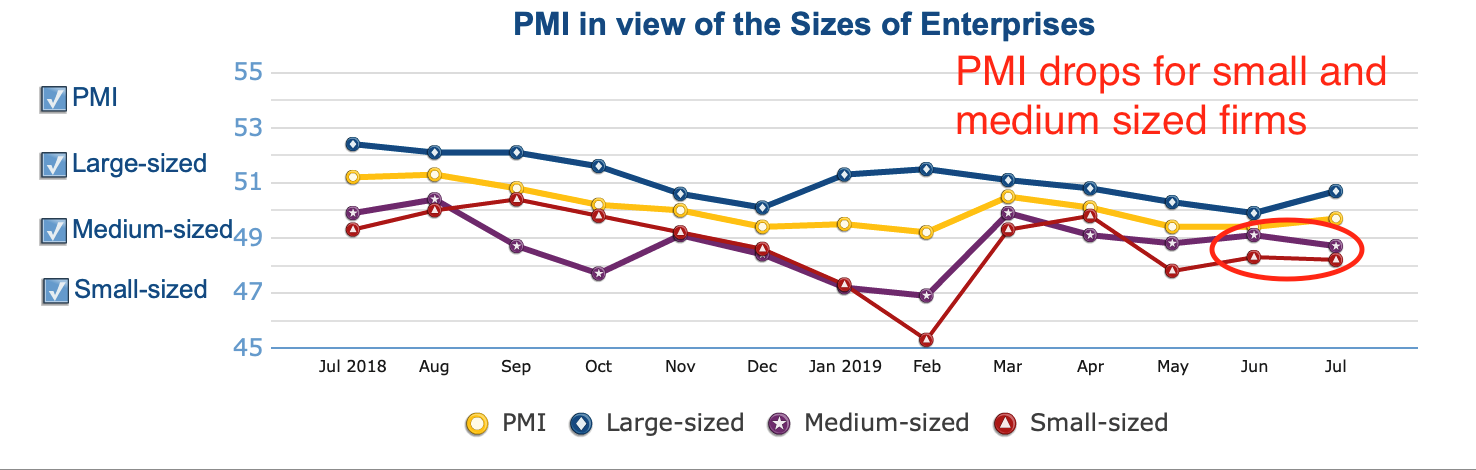

- Manufacturing activity in the context of firms’ size has grown only for large enterprises that could enjoy implicit guarantees or state preferences. The activity among firms of medium and small size fell.

- Stocks of raw materials and finished products increased, which indicates an increase in barriers to product sales. However, the deterioration of these indicators was preceded by a decrease in the leading indicators of new orders and corporate expectations in June.

At the meeting on Tuesday, the central committee of the Chinese Politburo deemed it necessary to increase fiscal and monetary (mainly targeted) economic support. This basically means a pledge to deliver more RRR cuts and authorize more risky investment projects undertaken by municipal governments through sale of special purpose bonds.

As for trade wars, there are two noteworthy events that deserve our attention. It is a new wave of Trump critics about flip-flop China’s position with respect to its pledge to ramp up agricultural purchases as well as Wilbur Ross’s remark about partial lifting of sanctions against Huawei. Trump said that if Chinese leaders will count on Trump’s failure in the 2020 elections, dragging out the negotiations, and if he wins, China can “only dream” of a deal on current conditions. In turn, Chinese officials and local newspapers accused the US of skittishness because of Trump words.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.